-

-

FeaturesคุณสมบัติPenyelesaianRecursosFiturCaracterísticas精选功能功能特點المزايا

-

Solutionsโซลูชั่นPenyelesaianSoluçõesSolusiSoluciones解决方案解決方案الحلول

-

IntegrationsการผสานรวมIntegrasiIntegraçõesIntegrationsIntegraciones集成整合服務دمج مع تطبيقات أخرى

-

Affiliate/Partnersพันธมิตร/พันธมิตรทรัพยากรAfiliasi/Rakan KongsiAfiliados/ParceirosAfiliasi/MitraAfiliados/Partners联盟/合作伙伴聯盟/合作夥伴شريك

-

ResourcesจองการสาธิตSumberRecursosSumber dayaRecursosالموارد資源中心

Transform Your Insurance Business with WhatsApp Business API

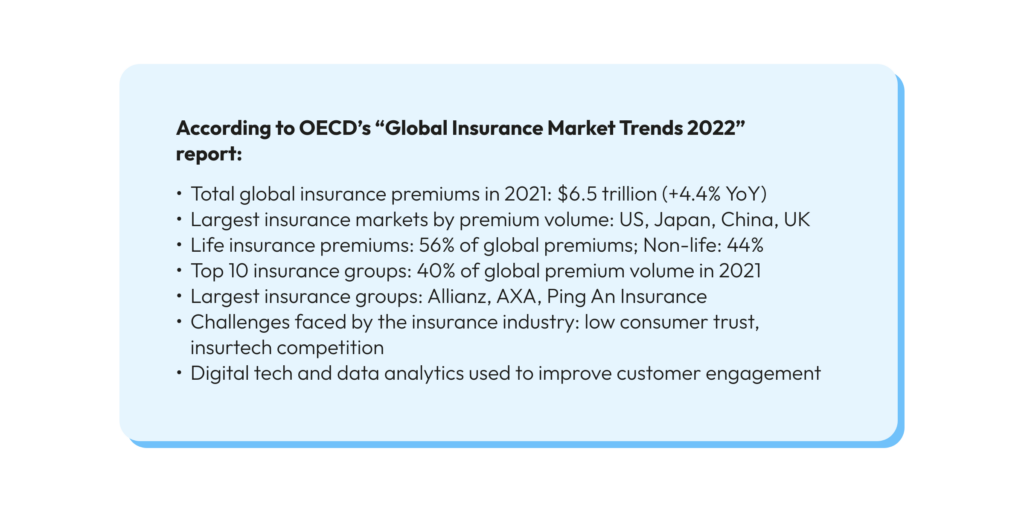

The digital transformation tide has undoubtedly transformed numerous industries, and the insurance sector is rapidly embracing this change. 🌊 At the vanguard of this shift stands the WhatsApp Business API for insurance, a tool that has become increasingly vital as the world grows more connected through smartphones and instant messaging applications.

Consequently, it’s hardly surprising that today’s consumers demand prompt and effortless communication. By tapping into the enormous potential of the world’s most widely-used messaging platform, insurance companies can secure a formidable advantage in this digitally-driven era. This strategic move not only aligns with current consumer expectations but also promises to streamline interactions and enhance customer satisfaction. 🚀

According to official statistics from WhatsApp Business, over 50 million businesses globally harness the power of their API for enhanced customer interactions. The insurance sector, with its unique challenges and customer expectations, can particularly benefit from such a tool. 📊

Come along with us at Wati as we delve into the transformative potential of this groundbreaking API, tailor-made for the modern insurance world. 🚀

Understanding WhatsApp Business API

When it comes to optimizing customer interactions in the insurance realm, the WhatsApp Business API for insurance emerges as a game-changing tool. 🎯 But what exactly is this API, and how does it differentiate from the regular WhatsApp Business App?

At its core, the WhatsApp Business API is a robust interface designed for medium to large businesses, enabling them to connect with customers at scale. 📈 According to WhatsApp’s official site, this API facilitates automated, secure messaging that can be integrated seamlessly with your business systems. For insurance providers, this translates to efficient claim processing, instant policy updates, and a host of other streamlined services.

Now, let’s dive into a comparative analysis:

| Feature | WhatsApp Business App | WhatsApp Business API |

|---|---|---|

| Target Audience | Small businesses | Medium to large businesses |

| Integration with Business Systems | Limited | Extensive |

| Automated Messaging | Basic chatbots | Advanced chatbot functionalities |

| Volume of Messages | Designed for fewer interactions | Built for large-scale messaging |

| Account Management | Single device access | Multiple users through CRM integration |

While the WhatsApp Business App is perfect for individual entrepreneurs or small businesses, the API version is tailored for larger enterprises, offering advanced functionalities. 💼

In essence, the WhatsApp Business API for insurance is not just an upgrade; it’s a revolution. It’s about harnessing the immense potential of WhatsApp, coupled with the specialized insights we offer at Wati, to redefine customer interactions in the insurance industry. 🌟

The Rise of Messaging in Business Communication

In the bustling world of business communication, the WhatsApp Business API for insurance stands out as a beacon of innovation. 🌟 As we trace the evolution of communication in customer service, it’s evident that messaging platforms have taken center stage, and for good reasons!

Decades ago, businesses relied heavily on emails and phone calls. While effective, these channels had their limitations – delayed responses, time zone differences, and the sheer formality of emails. Enter messaging platforms: they transformed the landscape with real-time, casual, and direct interactions. 📲 According to WhatsApp’s official data, a staggering 68% of users claim they feel more confident messaging businesses than calling or emailing.

So, why this paradigm shift? Here are some compelling reasons:

- Instant Gratification: In our fast-paced digital age, customers value real-time responses. Messaging offers instant replies, boosting customer satisfaction. ⚡️

- Convenience: Whether they’re commuting, working, or lounging at home, customers can shoot a quick message without the hassle of calls or formal emails.

- Personal Touch: Messaging feels personal, fostering a bond between businesses and customers. It’s a conversation, not just a transaction. 💬

- Multimedia Capabilities: From sharing images of damaged assets in insurance claims to sending policy documents, messaging platforms handle it all.

Harnessing the power of the WhatsApp Business API for insurance, as we champion at Wati, businesses can now craft superior, personalized customer experiences, leveraging the unmatched benefits of modern messaging. 🚀

Benefits of Integrating WhatsApp Business API in Insurance

The integration of the WhatsApp Business API for insurance is more than just a technological leap; it’s a strategic move for forward-thinking insurance providers. 🚀 With the digital landscape continually evolving, companies that tap into this potent tool are poised to offer unparalleled customer experiences.

a. Instant Communication 🚀

The insurance sector, historically known for its lengthy claim processes and complex policy details, is witnessing a transformative shift with the advent of the WhatsApp Business API for insurance.

- Quicker Claim Processing: Gone are the days when customers had to wait for days or even weeks for claim updates. With real-time chat enabled by the API, queries are addressed promptly, speeding up the claim processing timeline.

- Instant Policy Details and Updates: Customers no longer need to sift through heaps of paperwork or stay on hold over the phone. A simple message can fetch them their policy details, renewals, and critical updates in an instant.

b. Automated Customer Support 🤖

Automation is the future, and chatbots are leading the charge.

- Chatbots for Claim Status: Integrating chatbots can provide instant updates on claim statuses, reducing customer anxiety and enhancing transparency.

- Policy Details and FAQs: Instead of scouring through dense policy documents, customers can now get concise policy information and answers to common queries right through chatbots.

c. Document Sharing 📎

The paperwork-intensive nature of insurance is now simplified.

- Easy Sharing of Policy Documents: Customers can quickly receive their policy documents directly on WhatsApp, ensuring they always have access, even on-the-go.

- Claim Forms and Photos: In case of incidents, customers can easily share claim forms, photos of damages, and other relevant documents, streamlining the claim process.

d. End-to-End Encryption 🔒

Data privacy is paramount, especially in sectors like insurance.

- Ensuring Customer Data Privacy: The WhatsApp Business API for insurance comes with the promise of end-to-end encryption. This means all communications, be it chats, document exchanges, or photos, remain secure, and only the intended recipient can view them.

e. Feedback and Survey Collection 📊

Understanding customer needs and improving services is a continuous journey.

- Real-time Feedback: Post claim processing or policy renewal, businesses can instantly seek feedback. This real-time data helps in refining services and addressing any pain points.

- Survey Collection: With the API, insurers can push out surveys to gauge customer satisfaction, gather insights on new product offerings, or understand market needs.

Indeed, the WhatsApp Business API for insurance, as illustrated by our expertise at Wati, represents far more than a mere messaging service; it embodies a holistic approach specifically designed for today’s insurance landscape. By adopting this technology, insurers are positioned at the forefront, consequently offering services that align with the expectations of a digital-savvy clientele. Furthermore, this adoption paves the way for enhanced customer experiences, fostering stronger client relationships and driving business growth.

Use Cases of WhatsApp Business API in Insurance

In the dynamic insurance industry, the WhatsApp Business API for insurance is carving out a niche as an indispensable tool, reshaping customer interactions and streamlining processes. 🚀 The potential applications are vast, but let’s delve into some of the most impactful use cases:

a. Policy Renewal Reminders: 📅 Forget manual follow-ups or generic emails that get lost in the inbox clutter.

- Automated Reminders: With the API, insurance providers can send automated, personalized reminders to clients about upcoming policy renewals. This not only ensures timely renewals but also enhances customer retention.

b. Claim Status Updates: 🔄 Staying updated on claim statuses has never been this effortless.

- Real-time Notifications: Clients no longer need to incessantly check their claim status. The API facilitates real-time notifications, keeping customers informed about every processing stage, from receipt to approval.

c. Onboarding New Customers: 🤝 First impressions matter, especially in business.

- Simplified Onboarding: The WhatsApp Business API for insurance makes the onboarding process a breeze. From sharing policy options to answering queries, everything happens in a chat, making the experience interactive and personal.

d. Policy Recommendations: 💡 Every customer is unique, and so should be their insurance policy.

- Personalized Suggestions: Harnessing customer data and chat interactions, the API can be used to offer personalized insurance product recommendations, ensuring clients get policies tailored to their needs.

Implementing WhatsApp Business API: Step-by-Step Guide

Embarking on your journey with the WhatsApp Business API for insurance? Here’s a concise roadmap to get you started:

1. Getting Started: How to Obtain API Access: 📜

- Begin by visiting the official WhatsApp Business website. Here, you’ll find comprehensive details on obtaining API access, ensuring you meet all prerequisites.

2. Integration with Existing CRM and Customer Support Platforms: 🔄

- One of the API’s standout features is its seamless integration capabilities. With the right guidance, like the insights provided at Wati, you can effortlessly sync the API with your existing CRM, unifying customer data and enhancing support efficiency.

3. Setting Up Automated Responses and Chatbots: 🤖

- Dive into the world of automation by setting up predefined responses for frequently asked questions. Moreover, consider integrating chatbots for 24/7 customer support, ensuring clients always have a point of contact.

With the WhatsApp Business API for insurance and the expert insights from platforms like Wati, insurance providers are well-equipped to navigate the digital age, offering services that are not just efficient but also resonate deeply with modern customers.

Best Practices for Insurance Companies Using WhatsApp Business API

Utilizing the WhatsApp Business API for insurance is about more than just communication; it’s about building trust. Maintaining a professional tone in all interactions reinforces your credibility. 🤝 Every message should reflect the company’s integrity and commitment to quality service.

Data security is paramount. With end-to-end encryption, the WhatsApp Business API ensures that personal information stays between the insurer and the customer. 🛡️ Insurance companies must uphold these standards, routinely review their security protocols, and transparently communicate these measures to their clients.

Moreover, customer autonomy is critical. Clear opt-in and opt-out mechanisms empower customers, giving them control over their communication preferences. 🔄 This not only aligns with customer rights but also boosts their confidence in your services.

By adhering to these best practices and leveraging the resources at Wati, insurance companies can optimize their use of the WhatsApp Business API to deliver exceptional service while upholding the highest standards of professionalism and security.

Navigating the Exciting Terrain of WhatsApp Business API for Insurance

Diving into the WhatsApp Business API for insurance isn’t just about opening new doors to customer engagement—it’s about blasting through them with gusto! 🚀 But, as with any thrilling expedition, there are a few ‘dragons’ to slay. It’s essential to map out the API’s capabilities to ensure they match the epic quests of handling high volumes of customer interactions. Think of it as ensuring your armor is ready for battle! 🛡️

Sticking to WhatsApp’s business playbook is like following the adventurer’s code. Step out of line, and you might find yourself in murky waters—nobody wants to see their account marooned on ‘Suspension Island’. 🏝️

By skillfully maneuvering through these challenges with the wisdom found on Wati’s treasure trove, insurers can turn the WhatsApp Business API into their Excalibur, cutting through competition and forging bonds of loyalty with their customers. So gear up, set your sights on the horizon, and let’s make customer communication not just effective, but legendary! 🌠

Unlocking a Digital Revolution: WhatsApp Business API for Insurance

Absolutely, the WhatsApp Business API for insurance marks a significant shift in customer engagement and service delivery. 🚀 Insurance providers leverage this potent tool to break free from the constraints of outdated practices. They’re now navigating towards a horizon where responsiveness and ease are paramount. Utilizing the WhatsApp Business API doesn’t just mean staying in the race; it means leading the pack with innovation and foresight. 🌐✨

It’s time for insurance businesses to elevate their game. Embracing the WhatsApp Business API means engaging with policyholders on their turf, in an environment they trust and use daily. It’s about making every chat a stepping stone towards stronger relationships and seamless service. 🤝📲

By integrating this technology, as showcased by the experts at Wati.io, insurers can offer the kind of customer experience that doesn’t just satisfy, but truly delights. So let’s move forward, let’s innovate, and transform the way the world experiences insurance—one message at a time! 💬🚀

Frequently Answers and Questions about WhatsApp Business API for insurance

What is the WhatsApp integration for insurance?

Integrating WhatsApp for insurance means using the WhatsApp Business API to make communication between insurance companies and their customers smoother and more efficient. This integration enables automated messaging, efficient customer service, and seamless exchange of policy information.

Wati can facilitate this integration by providing a robust platform that simplifies the implementation process. Wati helps insurance companies handle customer chats, provide automated updates, and boost customer involvement using WhatsApp’s user-friendly platform.

Do insurance companies use WhatsApp?

Yes, many insurance companies have adopted WhatsApp as a communication tool to enhance customer service and engagement. They utilize WhatsApp to send policy documents, handle claims, and provide personalized support.

Wati aids insurance firms in using the WhatsApp Business API for insurance. It provides mass messaging, automatic workflows, and CRM system integration to simplify processes and improve customer service.

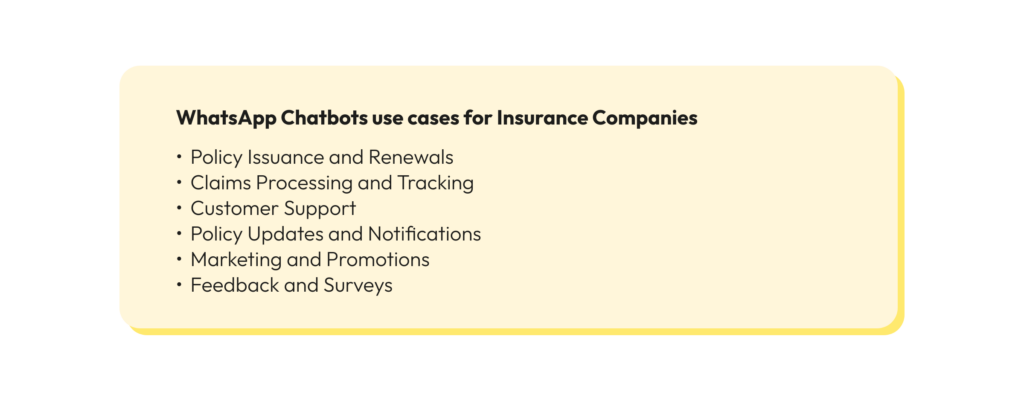

What is WhatsApp chatbot for insurance companies?

A WhatsApp chatbot for insurance companies is an automated messaging tool that uses artificial intelligence to interact with clients. It can answer queries, process claims, and offer instant support around the clock.

Wati provides an intuitive platform for creating and managing WhatsApp chatbots tailored to insurance services. These chatbots can handle a high volume of inquiries, provide instant responses, and route complex issues to human agents, all while maintaining the personalized touch that customers appreciate.

Can I use WhatsApp Business API?

Certainly, companies of any size can request to use the WhatsApp Business API. It is especially useful for medium to large businesses because it can scale with their growth.

Wati supports companies in not only obtaining access to but also maximizing the benefits of the WhatsApp Business API for insurance. Furthermore, Wati ensures adherence to WhatsApp’s stringent policies while offering a comprehensive suite of tools. These tools are designed to facilitate effective communication with customers and, moreover, automate responses. Additionally, Wati provides capabilities to monitor engagement metrics, which are essential for the continuous enhancement of services.

Latest Comments